Event organisers cry foul over levy

SHARE THIS PAGE!

By Matṧeliso Phulane

Local event organisers are up in arms over the tourism levy which they claim is unfair and is like a punishment, especially with the festive season looming – a time when business booms.

Introduced in July 2023, the tourism levy is a fee, tax or duty charged on consumers of tourism products such as events, tours, travel agents, attractions and accommodation.

The levy is expected to assist in marketing the country’s tourism attraction places locally and internationally, build capacity of tourism enterprises, develop and maintain tourism products and facilities, training of front liners as well as investment purposes and installation of tourism specific signage.

According to a statement issued by the Lesotho Tourism Development Corporation (LTDC) last week, “event organisers are hereby notified that as per tourism levy regulations 2021 amended in 2022, are required to collect 1.5 percent as Tourism Levy of total ticket price and remit such to LTDC.

“All event organisers are therefore, reminded to oblige, as failure to comply is an offence liable for a fine or conviction. The corporation also wishes to inform event organisers to seek permits from the department of tourism before holding an event, especially when alcohol is going to be sold there.”

In response, event organiser Bokang Kheekhe said it is good for events to be regulated by the levy.

Kheekhe is an organiser of events such as the ‘Maletsunyane Braai Festival, Selemo sa Basotho and Maseru Altitude Marathon.

“However, LTDC has to assist event organisers, like South Africa does, where the department of tourism contributes financially for the events to grow. But, none of that is happening in this country; the only thing they want is to collect levies from us.

“What they (government) are doing is similar to one harvesting where they have not sown. They should first plant a seed by contributing financially to events and thereafter, they can harvest the levy, not the other way round,” Kheekhe quipped.

He added that the levy is unfair to them as event organisers, and they have been appealing to the LTDC to take into account the challenges it pose to them.

Kheekhe disclosed that they were planning to hold a meeting with LTDC before the end of this week to address issues around the levy which he argued is not in their favour.

“The event organising business in Lesotho is not venerable due to lack of financial support; it is only advantageous to event organisers who have sponsors,” he told theReporter.

A member of the Events Association of Lesotho who preferred to speak on condition of anonymity also described the introduction of the tourism levy as ‘a good thing’. It would assist event organisers because the more they pay, the more it should benefit them in rewards.

He believes the tourism levy should be spent on tourist destinations to maintain infrastructure such as roads leading to venues, or to erect billboards to advertise events.

“We are not saying the tourism levy is wrong; the idea is good, we cannot deny that. The problem is how it is enforced. We’re not being consulted enough to give our opinions as we are the ones whose businesses it is going to affect, especially with the festive season approaching.

“LTDC does not give us any sponsorship, except providing us with their ‘Visit Lesotho’ logo. They always claim there are no funds whereas their mandate is to promote Lesotho and its activities,” the member noted.

He added that the levy must be used to boost the LTDC social media page where their events appear or at expos where they showcase events.

He also indicated that like any other business, event organisers were still recovering from the Covid-19 pandemic.

He reiterated that even though event organisers initially thought the levy was meant to help them, they now view it as a punishment.

“They should’ve at least started at 0.5 percent and increase it to one percent the following year until they get to the 1.5 percent; this would have given us enough time to recover fully and afford to pay.

“I don’t understand why we need a licence to sell alcohol at an event since the venue itself is already licenced. This shows that LTDC wants to earn double amounts, which is wrong.

“When we want sponsorships from individuals, the levy will impact how we spend the sponsorship. That will force us to tell our sponsors to top up the amount to accommodate the tourism levy, and this might cause trouble between a sponsor and an event organiser.”

Commenting on these complaints, LTDC’s tourism levy officer, ‘Masalang Khasake ,was adamant that consultative meetings were held with event organisers in the past and they know very well that they need to collect the levy. Some of them had even registered.

Khasake said last week’s statement was just a reminder in light of the festive season approaching, emphasizing the importance of the levy.

“Governments collect different types of tax such as tourism levy to boost the country’s development,” Khasake stated.

She explained that the levy applies to any leisure events that sell tickets, citing that ever since it was enacted in February 2021, some event organisers had actually collected and remitted to the government.

Asked if it is not too early for the event organisers to pay the tourism levy, considering the fact that the entertainment industry has been one of the slowest in terms of growth, Khasake said it is not early as the 1.5 percent is such a small percentage to charge a consumer.

“The tourism levy is not paid from the profits of the event organiser, but rather they charge on top of their ticket price. For instance, if an event ticket is M100, the consumer will pay M1.50 on top,” she explained.

According to the Tourism Levy Regulations 2021, the collected levy is meant to be used as follows: 50 percent collected will be used for the training of front liners, capacity building of the tourism enterprises, tourism signage as well marketing Lesotho as a must visit destination; 10 percent collected will be used for investment projects, another 10 percent for helping in the policy formulations by the parent ministry: and 30 percent for the general administration of the levy by LTDC.

High Court to rule on Lipholo bail bid

9 days ago

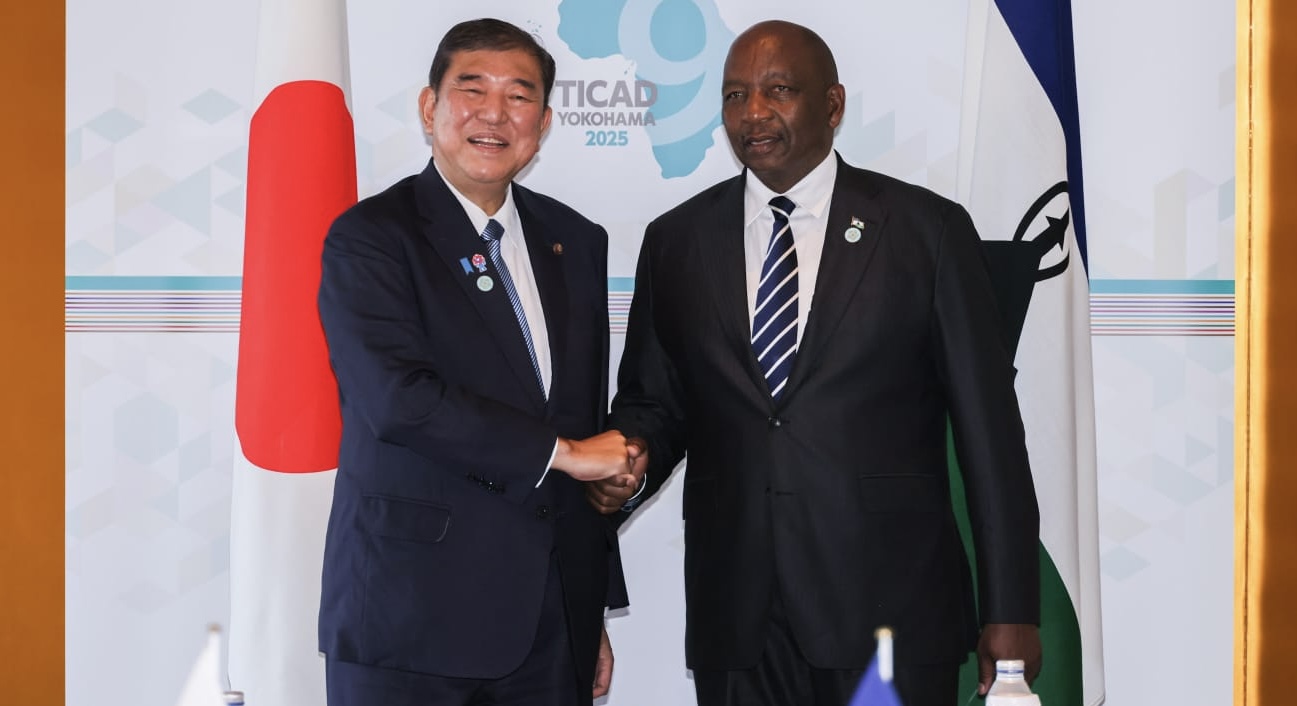

Lesotho, Japan to strengthen bilateral relations

12 days ago

US restores HIV lifeline to Lesotho

14 days ago

RSL, LNDC promote tax compliance

15 days ago

Tshiamiso wraps up Lesotho outreach

15 days ago

External risks threaten economic recovery – CBL

22 days ago