How much funeral cover is enough? (Part 1)

SHARE THIS PAGE!

Funeral cover is among the most popular and affordable insurance policies, especially in a country like Lesotho. This cover provides a cash payout to cover funeral expenses should a loved one pass away, providing financial relief and peace of mind knowing there is money available when you need it most. But how much funeral cover is enough?

This article discusses funeral covers and how many covers are enough.

How many policies do you need?

This depends on your individual and family needs and affordability. A good starting point is to:

- Identify the people whose passing is likely to impact your finances and cover them for example your immediate family, parents and close relatives.

- Source quotations and calculate if you can afford the monthly premiums based on your budget.

- Read the terms and conditions before buying the policy and signing to ensure you understand the product.

Can you have different funeral covers?

You are allowed to have policies with different insurance companies that offer benefits such as a cow, tombstone, airtime, grocery vouchers, mortuary needs and funeral services etc. You can choose from packages such as bronze, silver, gold and platinum depending on your specific needs and affordability.

Can you have too many policies?

Yes, you may be over-insured, where you have taken out too many funeral policies that eventually impact your monthly budget. A funeral policy is designed to cover funeral expenses and should not be used for profit-making for example ‘Lefu la hae lea mphelisa’. Get enough coverage to cover your loved onesand do not overspend on premiums.

What is the maximum amount you can claim?

Each person may be covered only once per policy, but multiple times across different policies. The maximum cash pay-out that an insurance company can pay on funeral policies is a maximum of LSL250 000.00 per life insured on valid claims. In the event whereby the insurer is unable to fulfil your claim due to the maximum cover, your total premiums will be refunded for all cover not paid out. Read the terms and conditions to ensure you are not over-insured come claim time. Consult your insurance broker or financial advisor to get advice and secure your financial well-being.

New border plan to advance regional trade

11 days ago

Foul language lands man in court

11 days ago

Youth demand action on unemployment

11 days ago

Ex-ministers threaten to sue govt

11 days ago

CBL launches LERIMA awareness campaign

11 days ago

Youth unemployment declared a state of emergency

12 days ago

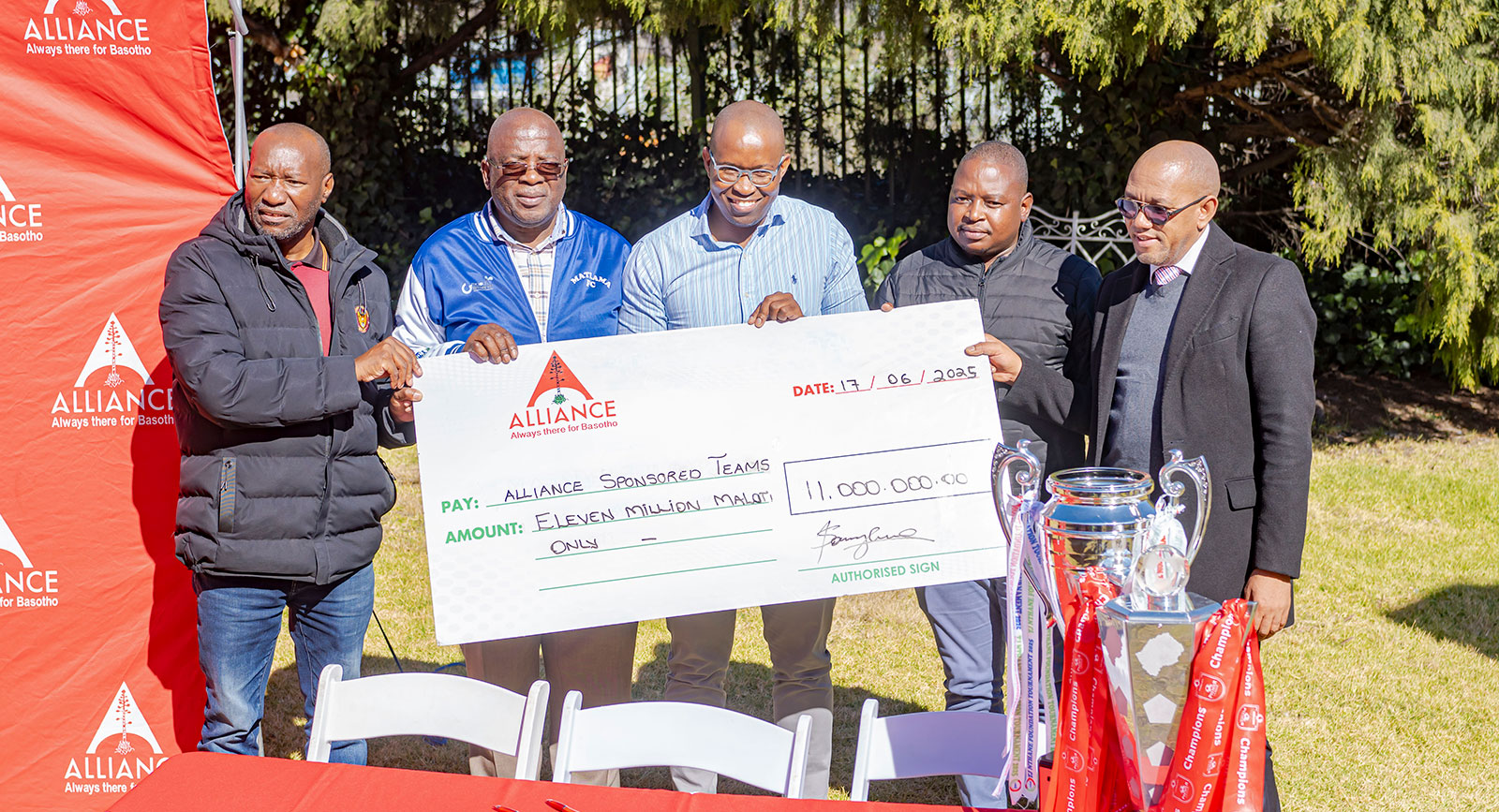

Alliance extends deal with premier league teams

13 days ago