RSL, SLB continue digital transformation journey

SHARE THIS PAGE!

Revenue Services Lesotho (RSL) has officially launched its Payment Gateway Integration with Standard Lesotho Bank.

The new system introduces four convenient payment options, USSD, Internet Banking, and Standard Lesotho Bank App, making tax payments faster, safer, and more accessible for all Basotho.

This integration strengthens efficiency, improves reconciliation, and enhances taxpayer experience as the two organisations continue their digital transformation journey.

The Commissioner of Business Enablement at Revenue Services Lesotho, Obed Nete, said this partnership did not begin today; it is the continuation of a journey that started in 2022, guided by a clear ambition to build a modern payment gateway that delivers the speed, transparency, and reliability that taxpayers expect from a 21st century revenue administration.

Nete noted that for many years, paying tax had been associated with queues at service

centres, piles of paperwork, and uncertainty. They’ve now taken a decisive step away from that reality.

“Through the integration of RSL’s systems with

Standard Lesotho Bank, we are reshaping the tax payment experience placing convenience, efficiency, and trust at the centre of service delivery,” he explained.

Nete also indicated that this integration significantly reduces manual processes and improves accuracy, turnaround times, and reliability.

To ensure system stability and a positive user experience, they implemented a pilot phase involving approximately 500 clients.

The pilot performed well, demonstrating reliable end-to-end processing and positive uptake across all channels.

Since the system went live in October 2025, they have already recorded 103 customs

transactions and 148 inland tax transactions, confirming both functionality and growing adoption.

Nete pointed out that their goal has always been to simplify tax payments while strengthening compliance.

This initiative builds on earlier integrations with Lesotho’s mobile network operators, creating a unified ecosystem where commercial banks, mobile money platforms, and agent networks work seamlessly together.

Moreover, by centralising payment processing on a single platform, the revenue authority is advancing its strategic objective of achieving 95% operational efficiency across core

tax and customs processes.

“More importantly, we are creating a consistent

and positive experience at every taxpayer touchpoint reducing time, and effort,” Nete added.

Bar exam delays frustrate law graduates

4 days ago

Golf event to raise funds for education

6 days ago

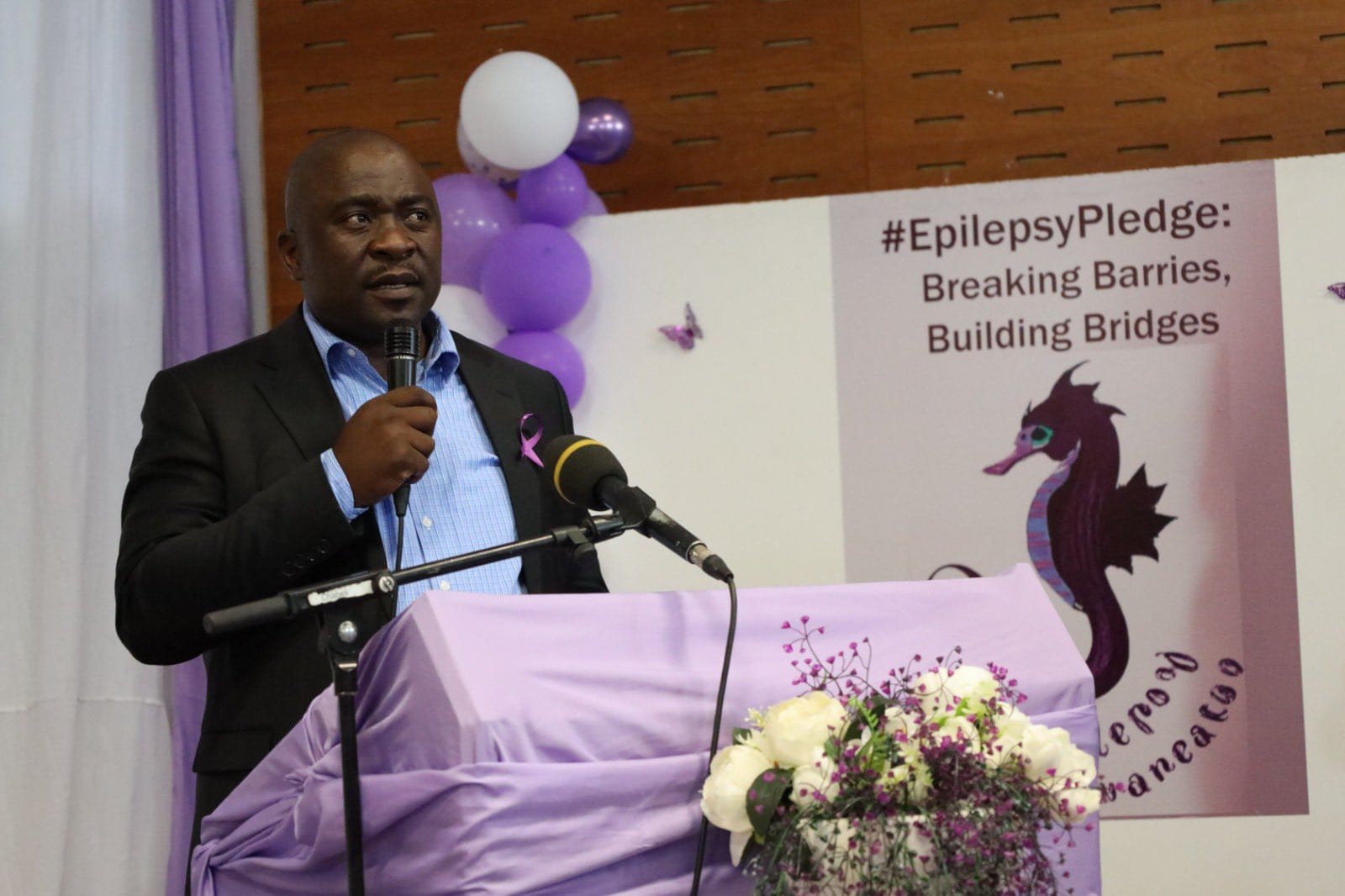

Lesotho marks World Epilepsy Day

6 days ago

Basotho students off to UAE

7 days ago

Wife demands all assets in divorce dispute

7 days ago