SLB launches lending campaign

SHARE THIS PAGE!

‘Mantšali Phakoana

Standard Lesotho Bank (SLB) on Tuesday this week launched the 2024 lending campaign proposition for personal banking for its clients.

Speaking at the launch, SLB head of personal banking, Teboho Sello said the initiative comes after a successful lending campaign which spanned from May to August 2023.

Sello noted that with the campaign, there are more amazing prices to be won by clients who will take up loans with SLB until May this year.

SLB offers Unsecured Personal Loans (UPL), Vehicle and Asset Finance (VAF) as well as home loans.

According to Sello, customers who will take any of the three loan types, namely unsecured personal loan, home loan or vehicle and asset finance loan will enter a draw and stand a chance to win one of five cash prizes of M20,000 each.

The minimum loan amount for UPL, VAF and HL is M150,000, M500,000 and M1,000,000 respectively.

“We have customers that won these prices last year and one of them is here to share the experience,” he said.

He indicated that the 2023 campaign disbursed a staggering M5.6 million in cashback incentives to hundreds of clients after they took up lending solutions, providing a much-needed boost to their financial aspirations.

Sello pointed out that the bank’s lending solutions are not just about banking, but about showing that SLB fully comprehends the needs of its customers and the requirements needed to make them enjoy what the bank has to offer.

Sello said the campaign has left a lasting impact on individuals and businesses, fostering financial empowerment and community development.

He stressed that SLB has and will always be thinking of the ways to create value for its customers and help them build a better future for themselves and their loved ones.

The bank believes the lending solutions address the challenges of today’s customer by making it even easier for them to achieve their dreams for a better life.

He noted that SLB remains the only bank that offers digital loans, where its customers are able to get loan offers on their digital gadgets and can get an instant loan at the click of a button.

“This is one way that has radically transformed our loan experience for our customers and we believe that we have made it more convenient.

“These are the fastest loans which can be disbursed because they are pre-approved by our smart digital systems based on the good account conduct of our customers. Our digital loans can be disbursed within seconds,” Sello explained.

He said SLB’s value proposition is essentially a gesture of its commitment to always serve customers better and create value to help customers realise their dreams.

“As a market leader, it is continuously a challenge for us to always map the way forward to bring something fresh that adds value and change the lives of our clients.

“I must emphasize at this point that indeed we do not rest. We are constantly honing our solutions and incentives framework geared towards making life easy for our customers and contributing to our economy,” he added.

High Court to rule on Lipholo bail bid

8 days ago

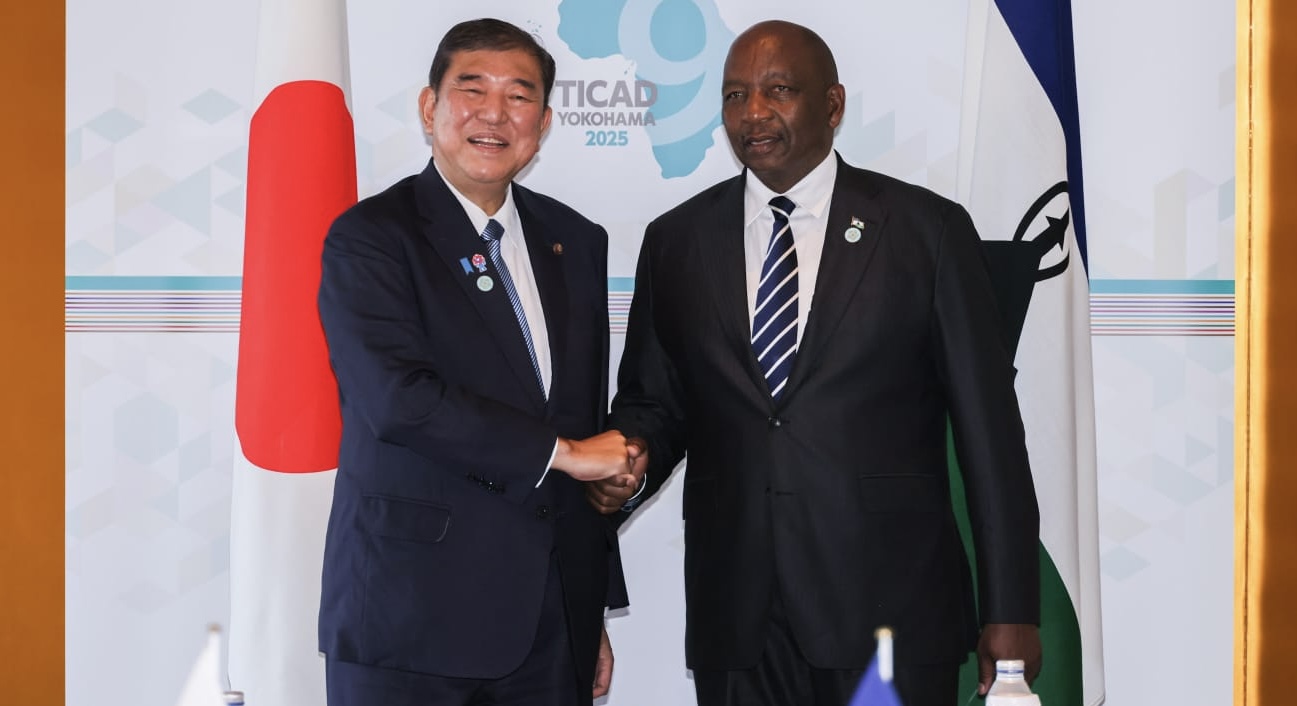

Lesotho, Japan to strengthen bilateral relations

11 days ago

US restores HIV lifeline to Lesotho

13 days ago

RSL, LNDC promote tax compliance

14 days ago

Tshiamiso wraps up Lesotho outreach

14 days ago

External risks threaten economic recovery – CBL

21 days ago