What is an insurable interest and why is it important?

SHARE THIS PAGE!

By TKay Nthebe

Insurance law and principles such as ‘Insurable interest’ can be complicated and difficult to understand. It is important, however, that Basotho educate themselves about insurance principles because risk management forms an important part of the financial plan. As discussed in last week’s article, for an insurance contract to exist, there must be an insurable interest.

What is insurable interest?

Insurable interest is an important principle in insurance law, which states that the insured must suffer a financial loss should the event insured against happen. Take Thabiso (the insured) who buys a brand-new Toyota Starlet for LSL280 000 for example. Thabiso will have an insurable interest because he would suffer a financial loss should the car be stolen or damaged. Insurable interest also refers to where an object like a house burns down or valuables are stolen or damaged.

In the case of long-term insurance, insurable interest is present in three scenarios only: That is through blood relations, marital relations, and Employer employee relations. In the absence of these, there is no insurable interest that can legally allow one person to pay for another through taking out a policy.

Nthabiseng’s children have an insurable interest in the life of their mother, the breadwinner as her death would leave her children financially vulnerable or suffer a financial loss. If Nthabiseng decides to cover her life by taking out a life cover policy (life assurance) to mitigate this risk, she (and her children) has an insurable interest.

In the same manner, employer A has insurable interest to the employees that he/she has. If such an employee leaves service of passes away, then the employer has legal obligation to pay out a certain amount in compensation.

How is insurable interest applied?

According to the Ombudsman for Long-term insurance (2006), there is a difference as far as insurable interest is concerned between short and long-term insurance. Using Thabiso as an example, at the time he takes out a car insurance policy and it is being issued, Thabiso must have the Toyota Starlet. Should he suffer a financial loss because his car is damaged or stolen, at the time of claiming, Thabiso must still have insurable interest over the car i.e., the car must still be Thabiso’s. Had Thabiso sold the car, he cannot claim it because there is no longer an insurable interest.

With long-term insurance, at the time the life cover policy is taken out, Nthabiseng must be alive for the insurance contract to exist. Should Nthabiseng die, her dependents will be able to claim from the life cover policy. The Ombudsman for Long-term insurance (2006) also provides other examples of insurable interest such as a person has an interest in the life of his/her spouse, a parent has an interest in the life of his/her child (whether legitimate or not) or child has an interest in the life of his/her parents. This list is however not exhaustive, and terms and conditions apply.

It is important to understand and grasp the principle of ‘insurable interest’ such that you make informed financial decisions. Next week’s article will discuss another important insurance principle – indemnity insurance and non-indemnity insurance. Should you need more information regarding insurable interest, speak to your insurance broker or visit www.alliance.co.ls

New border plan to advance regional trade

11 days ago

Foul language lands man in court

11 days ago

Youth demand action on unemployment

11 days ago

Ex-ministers threaten to sue govt

11 days ago

CBL launches LERIMA awareness campaign

11 days ago

Youth unemployment declared a state of emergency

12 days ago

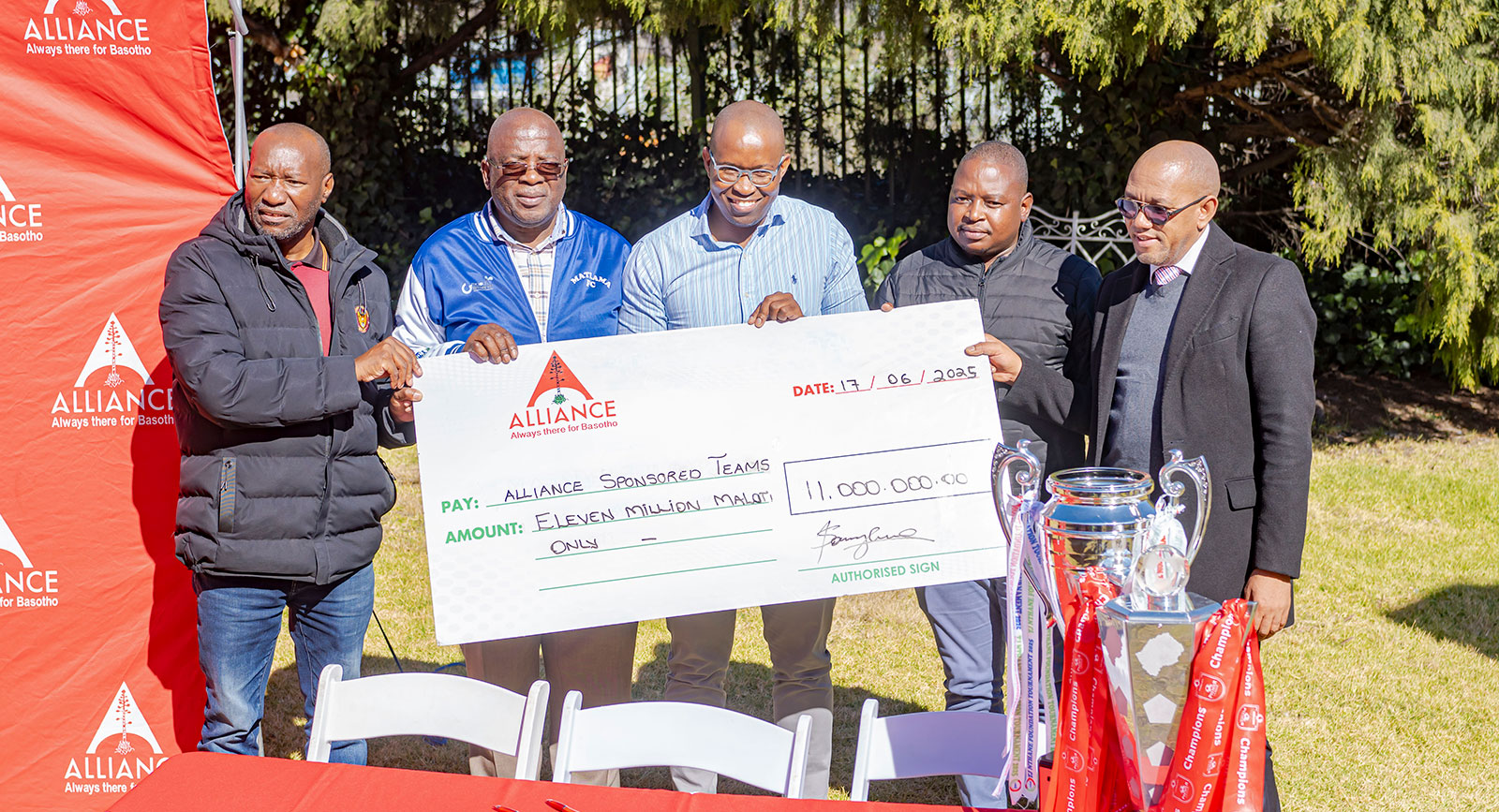

Alliance extends deal with premier league teams

13 days ago